The UK and London Property Market in 2023: A Detailed Outlook

Updated on: January 27, 2023

Understanding the UK and London Property Market in 2023

The UK and London property market in 2023 remains under the spotlight for investors, private banks, and wealth managers across the globe. London continues to perform as one of the most resilient ultra-prime property destinations, driven by its financial infrastructure, cultural influence, and world-class education sector. It consistently attracts international buyers, family offices, and expats seeking both long-term security and tailored financing solutions for complex purchases.

Adding to the global spotlight, the coronation of King Charles III in 2023 further reinforced London’s international standing, drawing worldwide attention and tourism — a positive backdrop for its high-end property market.

House Price Trends Across 2023

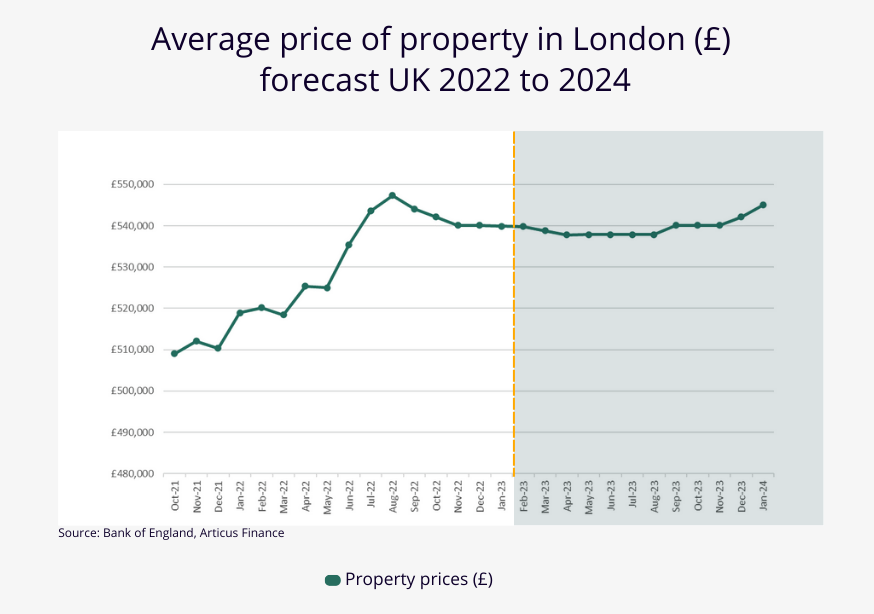

Forecasts for the UK and London property market in 2023 began with caution. According to Forbes, UK house prices dropped by 1.5% in December 2022, marking the fifth consecutive monthly decline. Analysts suggested that house prices could fall by up to 5% over the course of the year. While this correction reflects cooling demand, it follows two years of substantial growth during the pandemic-driven cycle.

As a result, commentators view 2023 less as a downturn and more as a strategic entry point for buyers. With demand temporarily muted and supply improving, the environment is increasingly a buyer’s market where investors and individuals can negotiate more favourable terms and re-enter premium neighbourhoods that were previously overheated.

Why International Buyers Find Value This Year

- A true buyer’s market, providing more room for negotiation.

- The weak pound continues to make UK real estate more affordable in global currency terms.

- Mortgage pricing has become more competitive, with rates gradually falling as lender competition intensifies.

- Rental yields are attractive due to a surge in demand within the leasing market.

- Access to specialist financing such as bridging, commercial and development loans is widely available.

- Structuring finance allows for potential tax efficiencies.

For many expats and overseas buyers, this mix of conditions creates a rare opportunity. The UK and London property market in 2023 allows well-capitalised investors to secure premium assets at more attractive valuations, particularly when coupled with bespoke finance structuring from brokers and private banks.

Inflation, Interest Rates and Their Impact

Macroeconomic conditions remain a dominant theme for the UK and London property market in 2023. Inflation, which peaked in late 2022, has since begun to fall. By January 2023, levels were trending downwards, with full-year expectations to settle closer to 6%, and forecasts to return towards the Bank of England’s 2% goal by 2024.

The Bank of England base rate continues to play a balancing role. While marginal increases are predicted, much of this has already been priced in by lenders. Notably, competitive mortgage products and falling rates in recent months reinforce that lenders expect stabilisation ahead.

Investec suggested that the BOE may even be the first major bank globally to reduce rates once conditions allow. For investors navigating these shifts, strategic financing — including refinancing at private banks or using interest-only structures — has proven essential.

Opportunities for UHNWIs and Family Offices

For ultra-high-net-worth individuals, the UK and London property market in 2023 provides both stability and opportunity. Despite a temporary cooling in property prices, long-term fundamentals remain robust, ensuring London’s continued reputation as a wealth-safe jurisdiction.

- Purchasing luxury assets at discounted valuations compared to 2021–22 highs.

- Leveraging private bank mortgage lending to fund large transactions.

- Capturing rental growth through BTL and HMO-focused property structures.

- Utilising bridging finance and development exit loans for short-term and opportunistic transactions.

Cross-border buyers are especially active, with many leveraging exchange rate advantages to secure assets in pound-denominated markets while conditions remain favourable.

Articus Finance: Delivering Tailored Solutions

Articus Finance achieved a record year in 2022, more than doubling client financing secured. We managed complex arrangements spanning development finance, bridging deals, and private bank coordination. In response to surging client demand, we expanded our specialist broker teams and administrative support functions, ensuring processes remained efficient and tailored even as volumes grew.

For 2023, our commitment is clear: to continue providing sophisticated investors with access to our network of over 500 lenders — from established retail banks to exclusive international private institutions — ensuring our clients stay ahead of market shifts in the UK and London property market in 2023.

Our Proven Expertise

With over 20 years of combined experience, Articus Finance brokers bring extensive knowledge of structuring sophisticated transactions for HNWIs, family offices, expats and overseas investors. We pride ourselves on discreet and creative solutions — no matter how complex the deal. Our team holds relationships with leading UK and international lenders, ensuring access to bespoke products and exclusive rates often unavailable in the wider market.

Final Thoughts

The UK and London property market in 2023 presents a landscape of strategic opportunity over short-term speculation. Prices may soften further, but long-term fundamentals — from London’s financial strength to its continued global demand — remain firmly positive. For those who take a structured, expert-advised approach, this period represents an excellent chance to build or refine portfolios.

Articus Finance continues to guide global clients across property and financial markets with discretion, insight, and lender access at every level. Connecting with the right advisers and securing the right product structures remains the key to success for international investors and UHNWIs navigating this market cycle.

Related Reading

- High Net Worth Mortgages

- Foreign National Mortgages

- Commercial Mortgages

- Mezzanine Finance

- Life Insurance for Investors

- Expat Buy-to-Let Mortgages

- Bridging Finance Solutions

External reference: Bank of England